Here’s a summary of the news articles:

Market News

- US stocks opened higher on Tuesday, with the S&P 500 up 0.3% and the Dow Jones Industrial Average up 0.3%.

- Nvidia (NVDA) stock rose as much as 2.5% in premarket trading after CEO Jensen Huang’s keynote at CES.

- The Nasdaq Composite (^IXIC) added around 0.2%.

Economic News

- Job openings increased more than expected in November, with 8.1 million jobs open at the end of the month.

- The hiring rate fell to 3.3% from 3.4% in October, and total quits decreased to 3.07 million from 3.28 million in October.

- The Job Openings and Labor Turnover Survey (JOLTS) also showed that 5.27 million hires were made during the month.

Interest Rates

- The Federal Reserve’s next interest rate cut is now seen as less likely, with traders giving a less than 50% chance of a cut before the central bank’s June meeting.

- The 10-year Treasury yield (^TNX) quickly moved higher after the release, adding roughly 7 basis points to hover just below 4.7%.

Fed Watch

- The CME FedWatch Tool now shows that traders see a less than 50% chance of the Fed cutting interest rates before June.

- Yesterday, traders saw a roughly 55% chance of the Fed cutting interest rates by at least 25 basis points by the end of its May meeting.

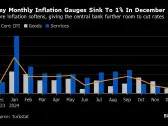

Inflation

- The prices paid index rose to a nearly two-year high of 64.4, from 58.2, which is consistent with PCE supercore inflation remaining at 3.5% until mid-next year.

- This serves as a reminder that the Fed’s fight against inflation is not over.

Nvidia

- Nvidia (NVDA) CEO Jensen Huang unveiled AI superchip and robotics tech at CES, which helped lift market sentiment for the company.

Other News

- Shutterstock and Getty Images will join to become a $3.7 billion visual content company.

- Meta has elected UFC CEO Dana White and two others to its board.

- Disney was willing to pay up for Fubo in its quest to launch a new sports streamer.

- US companies are pulling back on diversity initiatives.

Let me know if you’d like me to summarize anything further!