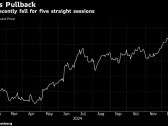

The latest data from Statistics Canada suggests that retail sales in the country have risen for the fourth consecutive month, a significant improvement since early 2022. This upward trend is likely due to the Bank of Canada’s interest-rate cuts, which are making borrowing costs more affordable and boosting consumer spending.

Retail Sales Growth: A Welcome Sign

The advanced estimate released by Statistics Canada indicates that receipts for retailers jumped 0.7% in October, marking the strongest pace since July. This growth follows a 0.4% gain in September, showing that the upward trend is continuing. The third-quarter retail sales were up 0.9% compared to the first half of the year, which experienced the largest contraction since 2009 outside the pandemic.

Impact of Interest Rate Cuts

The Bank of Canada’s decision to reduce interest rates has likely contributed to the increase in consumer spending. In October, the bank cut interest rates by 50 basis points to strengthen economic activities. Although last month’s inflation re-acceleration lowers the odds of another jumbo cut in December, policymakers are expected to continue cutting gradually to make borrowing costs less restrictive.

Prime Minister Trudeau’s Stimulus Package

In a move aimed at further boosting consumer spending, Prime Minister Justin Trudeau’s government announced plans to waive federal Goods and Services Taxes (GST) on items such as prepared foods, some alcohol, books, and toys over the winter holidays. Additionally, a one-time check of $250 will be given out to nearly 19 million Canadians in the spring. This stimulus package is expected to provide a boost for retail sales in December but may dent activity in November as consumers delay purchases.

Regional Variations

Regionally, sales were up in five of ten provinces, with Alberta seeing the largest increase of 2.3%. The statistics agency didn’t provide details on the October estimate, which was based on responses from 58.9% of companies surveyed. The average final response rate for the survey over the previous 12 months was 88.9%.

Expert Analysis

Economists are cautious in their assessment of the retail sales growth. Katherine Judge, an economist at Canadian Imperial Bank of Commerce, notes that per-capita retail sales volumes are still sitting 1.8% below year-ago levels as of September, showing that there is ample lost ground to make up.

"This is early evidence that lower interest rates are supporting spending," said Judge. "However, the upcoming GST holiday will provide a boost for retail sales in December but it could dent activity in November as consumers delay purchases."

Charles St-Arnaud, chief economist at Alberta Central, added that signs of consumer spending improving on a per-capita basis will be welcomed by the Bank of Canada. He noted that once we add the further support coming from the temporary GST cut, it seems more likely that the Bank of Canada will cut by 25 basis points in December than by 50 basis points.

Conclusion

The rise in retail sales for the fourth consecutive month is a welcome sign for the Canadian economy. The interest-rate cuts and stimulus package announced by Prime Minister Trudeau’s government are likely contributing to this growth. However, economists caution that per-capita retail sales volumes are still below year-ago levels, indicating that there is room for further improvement.

Sources:

- Statistics Canada

- Bank of Canada

- Canadian Imperial Bank of Commerce

- Alberta Central

Share Your Thoughts:

What do you think about the rise in retail sales? Will the stimulus package and interest-rate cuts continue to boost consumer spending?

Join the Conversation:

Join our community to share your thoughts, ask questions, and engage with others on this topic.

Related Stories:

- What will be tax-free under Trudeau’s promised GST/HST break

- Retail industry praises GST holiday

- Inflation rate ticks up, cooling hopes of bigger Bank of Canada cut