AI Illusions and Navigating ‘The Money Trap’ with Alok Sama

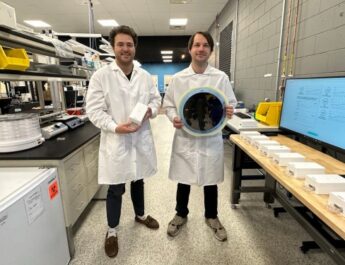

In today’s fast-paced world of technology and investment, it can be challenging to separate fact from fiction. With the rise of artificial intelligence (AI) and its increasing presence in our daily lives, many are left wondering whether we’re witnessing a technological revolution or simply an illusion. To gain insight into this complex landscape, I sat down with Alok Sama, a seasoned veteran of Morgan Stanley and former president and CFO of SoftBank Group International.

A Conversation with Alok Sama

Sama’s extensive experience in the tech industry makes him an ideal guide for navigating the ever-changing landscape of technology investments. With his upcoming memoir, ‘The Money Trap: Lost Illusions Inside the Tech Bubble,’ set to release on September 17, I had the opportunity to discuss his views on AI, its impact on society, and the lessons he’s learned throughout his career.

Apple and AI Musings

Our conversation began with a discussion of Apple’s recent announcements. Sama shared his thoughts on the tech giant’s introduction of AI-powered functionality in their iPhone 16 lineup. While acknowledging that the consumer-level impact is still in its early days, he expressed caution regarding the hype surrounding AI. "At the consumer level, [the impact of AI] is very early days," Sama said.

Sama also touched on the high valuations of companies in the AI space, including Nvidia ($3.3 trillion), Anthropic ($18.4 billion), OpenAI ($100+ billion), and xA1 ($24 billion). While acknowledging that these valuations are indeed sky-high, he downplayed concerns about an impending AI bubble bursting.

The Psychology of Investment Hype Cycles

Sama’s discussion on the psychology of investment hype cycles was particularly insightful. He pointed out that investors often prioritize growth predictions over traditional metrics like revenue and profits. This trend is not unique to the current era; in fact, Sama noted that it has been a hallmark of Silicon Valley’s investing culture for decades.

To illustrate this point, he shared an anecdote about SoftBank’s founder, Masayoshi Son, who passed on investing in Facebook at a $10 billion valuation in 2009. Fast-forward to today, and Meta’s valuation stands at over $1 trillion. Sama highlighted the importance of balancing due diligence with a willingness to take calculated risks.

The Incestuous Nature of AI Investments

Sama also drew attention to the interconnectedness of investments within the top AI players. He noted that companies like Nvidia and Microsoft are investing in OpenAI, which then spends money on Microsoft Cloud, creating a circular pattern of investment.

This incestuous nature of investments has led Sama to question whether we’re witnessing an AI bubble bursting or simply a reflection of the industry’s growing complexity. While he acknowledged the risks associated with high valuations, he emphasized that Nvidia’s performance is not disconnected from reality.

The Money Trap: Lessons Learned

Throughout our conversation, Sama touched on various aspects of his memoir, ‘The Money Trap: Lost Illusions Inside the Tech Bubble.’ He shared insights into the precedent set in Silicon Valley for prioritizing growth over traditional metrics and the dangers of ignoring warning signs.

Sama’s experiences serve as a valuable lesson to investors and entrepreneurs alike. By acknowledging the complexities of AI investments and the psychology of hype cycles, we can better navigate the ever-changing landscape of technology and investment.

Conclusion

As we continue to grapple with the implications of AI on our society, it’s essential that we approach this complex topic with caution and nuance. Alok Sama’s insights offer a unique perspective on the tech industry, highlighting both the opportunities and challenges presented by AI.

By understanding the psychology of investment hype cycles and acknowledging the interconnectedness of investments within the top AI players, we can make more informed decisions about our investments and better navigate the ever-changing landscape of technology and investment.

About Alok Sama

Alok Sama is a seasoned veteran of Morgan Stanley and former president and CFO of SoftBank Group International. His extensive experience in the tech industry makes him an ideal guide for navigating the complex world of AI investments.

About Rebecca Bellan

Rebecca studied journalism and history at Boston University. She has invested in Ethereum and covered social media for Forbes.com, with her work appearing in Bloomberg CityLab, The Atlantic, The Daily Beast, Mother Jones, i-D (Vice), and more.

Related Articles

- Uber CEO Dara Khosrowshahi Resigns from Self-Driving Truck Startup Aurora’s Board

- Inside the Wild Fall and Last-Minute Revival of Bench, the VC-Backed Accounting Startup That Imploded Over the Holidays

- Apple TV+ Is Free to Stream This Weekend