Apple Inc. Shares Struggle Amidst China Concerns

Weakness in Chinese Market Continues to Weigh on Apple’s Performance

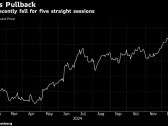

Apple Inc. shares have had a challenging start to 2025, with investors fretting over weakness in the critical Chinese market. The company’s stock has fallen for five straight sessions before Monday’s bounce, marking its longest losing streak since April.

China Smartphone Data Paints a Bleak Picture

The shares slipped as much as 1% in Tuesday trading, hurt by a downgrade to sell at MoffettNathanson. Analysts led by Craig Moffett wrote that the Chinese market is "vexing" for Apple, with the company losing market share among Chinese consumers and facing potential trade war risks.

Chinese Market: A Crucial but Challenging Area for Apple

The greater China region accounts for 17% of fiscal 2024 revenue, making it a significant contributor to Apple’s overall performance. However, analysts see $21.7 billion in greater China revenue in the first quarter, which is a decline from previous estimates.

Concerns Over Tariffs and Trade Wars

David Wagner, portfolio manager at Aptus Capital Advisors, believes that investors who had looked past a lukewarm response to the artificial intelligence-infused iPhone and tariff-related risks under the incoming Trump administration may have lost patience. "It increasingly seems like China just won’t be there as an avenue for growth at Apple, given an overall weaker smartphone market, competition from Huawei, and the risk of tariffs," he said.

Valuation Concerns

Wagner also pointed out that Apple’s elevated valuation could make it vulnerable to risks in the Chinese market. The company trades at more than 32 times estimated earnings, above its long-term average and higher than the Nasdaq 100 Index at around 27 times. This is even more expensive than Microsoft Corp. and not far off Nvidia, both of which are expected to deliver much stronger growth this year.

Decline in China Revenue

Apple’s most recent quarterly report showed a decline in China revenue last quarter, adding to concerns about its overall growth trajectory. Sales growth has been negative in five of the company’s past eight quarters, and while it is expected to pick up next year, the pace is seen below that of other megacaps.

Tech Industry Update

Meanwhile, Nvidia Corp. rallied 3.4% on Monday to close at a record high of $149.43 ahead of CEO Jensen Huang’s keynote at the CES trade show in Las Vegas. The stock, which added more than $120 billion in market value on Monday, wavered in Tuesday trading after the company announced a raft of new chips, software and services, aiming to stay at the forefront of AI computing.

Key Developments

- Nvidia outlined its products and strategy to his audience of hundreds for more than 90 minutes, including tie-ups with Toyota Motor Corp. and MediaTek Inc.

- Meta Platforms Inc. elected three new directors to its board, including Ultimate Fighting Championship Chief Executive Officer Dana White

- Microsoft Corp. plans to spend $3 billion to expand its cloud computing and artificial intelligence capabilities in India

- The US has blacklisted Tencent Holdings Ltd. and Contemporary Amperex Technology Co. Ltd. for alleged links to the Chinese military

Earnings Due Tuesday

No major earnings are expected this week, but investors will be watching closely for any updates from tech companies.

Conclusion

Apple’s performance is being closely watched by investors, with concerns over China’s growing economy and potential trade wars weighing on the company’s shares. While the decline in China revenue may have some investors worried, Apple’s strong cash flow and large installed base could provide a cushion against any downturns.