The fintech industry has been abuzz with the emergence of Banking-as-a-Service (BaaS), embedded finance, and open banking. These innovative concepts have sparked excitement among financial institutions, startups, and investors alike, promising to disrupt traditional banking models and create new opportunities for growth.

A New Era in Financial Services

The promise of BaaS is to make opening a bank account, storing money, receiving a payment card, and lending money as easy as signing up for a social media platform. This vision of the future is already underway, with several key players leading the charge.

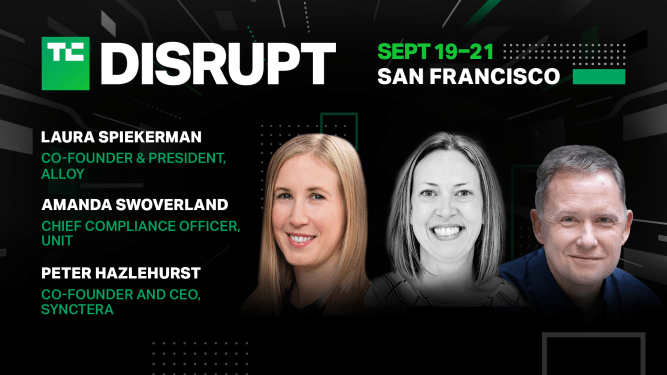

At TechCrunch Disrupt 2023, we’re excited to welcome three influential experts in the field:

- Peter Hazlehurst, co-founder and CEO of Synctera

- Laura Spiekerman, co-founder and president of Alloy

- Amanda Swoverland, chief compliance officer at Unit

These visionaries will share their insights on how a new breed of finance infrastructure companies is poised to transform the financial services landscape.

The Rise of BaaS: Market Potential and Funding

Despite a tumultuous year marked by mergers, acquisitions, and layoffs, the BaaS sector has continued to attract significant investment. According to estimates, the market is expected to reach nearly $66 billion by 2030, with venture dollars pouring in.

Recent funding rounds demonstrate the potential of this space:

- Synctera raised $15 million in March 2023 to launch embedded products in Canada

- Unit secured a $100 million round in May 2022 at a valuation of $1.2 billion

- Alloy raised $52 million in September 2023 at a valuation of $1.55 billion, just 11 months after securing $100 million at $1.35 billion

These figures underscore the immense market potential and investor interest in BaaS.

Meet Our Speakers

Peter Hazlehurst: Synctera Co-Founder and CEO

With nearly 30 years of experience creating financial products for banks, fintechs, and large tech companies, Peter Hazlehurst brings a wealth of expertise to the table. His impressive track record includes:

- Building core banking technology for Phoenix in 1993

- Leading product teams at Uber Money, Postmates, Google, and Yodlee

Hazlehurst’s vision and leadership have been instrumental in shaping the fintech landscape.

Laura Spiekerman: Alloy Co-Founder and President

As a renowned fintech entrepreneur, Laura Spiekerman has made significant contributions to the industry. Her achievements include:

- Leading business development and partnerships at an ACH payments startup

- Working on the research and investment team at Imprint Capital Advisors (acquired by Goldman Sachs)

Spiekerman’s innovative approach and dedication have earned her a reputation as a thought leader in fintech.

Amanda Swoverland: Unit Chief Compliance Officer

Amanda Swoverland brings a unique perspective to the conversation, with a deep understanding of regulatory compliance. Her expertise includes:

- Developing and implementing compliance programs for financial institutions

- Providing guidance on emerging trends and best practices in BaaS and embedded finance

Swoverland’s insight will help attendees navigate the complex landscape of financial regulations.

Conclusion

The convergence of BaaS, embedded finance, and open banking is poised to revolutionize the financial services industry. With significant investment pouring into the space and innovative companies leading the charge, the future looks bright for this sector.

Join us at TechCrunch Disrupt 2023 to explore the latest developments in BaaS and embedded finance. Our speakers will share their expert insights, providing valuable guidance on how to navigate the evolving landscape of financial services.